Value-based care is only one small piece of a staggering amount of change underway in healthcare. Below are “cliff notes” on everything else that’s happening at at the same time.

Value-based care is only one small piece of a staggering amount of change underway in healthcare. Below are “cliff notes” on everything else that’s happening at at the same time.

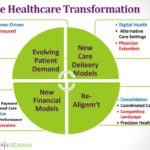

HEALTHCARE TRANSFORMATION GRAPHIC

-

Evolving Patient Demands: Consumer-Driven | Digital | Underinsured | Aging Patients

Patient behavior today is undergoing a few distinctive, inter-related evolutions: an aging population managing chronic diseases; a healthcare marketplace transitioning towards a consumer-driven future of demanding, better informed patients, who are facing greater responsibility for their own care as a result of underinsurance. These three distinct transformations are reshaping the patient market and driving value in healthcare ventures. They present challenges and opportunities for healthcare providers to adapt to meet emerging demand.

- Consumer – and Digitally Driven: To quote Dr. Eric Topol, the healthcare era of “[t]he doctor will see you now” has been replaced with “[t]he patient will see you now.” It was only a decade ago that we were talking about the shift to a system that was “patient-centric”. Doctors quickly learned to adjust to patients showing up to appointments armed with information gathered on Google and empowered for the first time to look for second opinions, question doctors’ advice, and advocate aggressively for themselves. Now, we are moving to the next step in the progression, from consumer-centric to consumer-directed. Consumers are in control of their healthcare choices, and healthcare plan and providers need to adjust for this shift in power.

While WebMD enabled consumers to investigate diagnoses for nearly two decades (since 1996) and online personal health records allowed consumers to manage their own health records, consumers today can assess providers through data, cutting through the opacity of healthcare pricing and quality. The related trend is radically greater expectations of convenience: the same consumers who cannot imagine what it was like to order a car service before Uber and are trying going cash-less via Apple Pay are looking for the same level of convenience in healthcare. Patients are clamoring for digital healthcare or, at a minimum, digitally arranged, healthcare. Even for visits for in-person care, patients will demand the ability to eliminate the inconveniences of paperwork, long waits, and traditional phone scheduling via digital solutions.

- Underinsured: While the Affordable Care Act expanded access to care, the concomitant erosion of the value of health insurance benefits has led to a significant majority of Americans who cannot afford the care they need. This is a broader problem that insurance coverage does not address; even with health insurance, many patients cannot afford their share of personal responsibility for deductibles, co-payments, and uncovered expenses. While this may dictate greater attention to wellness and preventive care to reduce costs, and greater use of advance directives to reduce end-of-life spending, the bad news is that many people will forego needed care and medications. Others will see their savings depleted by their medical costs. It will also drive a growing interest in new forms of financing to spread out costs over time.

- Aging: The “silver Tsunami” is a game-changer for U.S. healthcare. The “old old” have become the fastest growing population segment in the country. The oldest Baby Boomers have begun to hit Medicare eligibility and the rest will join the ranks of Medicare over the next two decades. This explosion of the senior population will drive Medicare spending, as chronic diseases (and diseases of prosperity) associated with aging (e. cancer, heart disease, diabetes) affect a larger percentage of the population. It will drive the growth of Medicare-covered services and also the market for non-covered services, as more and more people will need help with activities of daily living. For evidence of the latter, check out the explosion in privately funded homecare.

-

New Care Delivery Models: Digital Health | Alternative Care Settings | MD Extenders

- Digital Healthcare: We are living through a time when many straightforward healthcare conditions are likely to be treated seamlessly via data-driven digital care and connectivity. As wearable technologies and smart phone diagnostic tools improve, patients are better positioned to identify and manage their own health issues, in a radically more efficient manner than the days of visiting doctors for basic diagnostics. Doctors will rely on patient-reported cardiopulmonary vitals to prescribe. The smartphone and the online video appointment won’t supplant the treatment of complex conditions, but the ability to snap photos of skin lesions for diagnosis and to get less complex, diagnosable conditions treated remotely represents a care delivery model that is only going to grow in popularity.

Beyond wearable technology, the bed-ridden can now be monitored through new telemonitoring technologies and the ability of devices to communicate via the Internet of Things. New nanotechnology solutions, including chewing gum with sensors, are expanding the digital health diagnostic opportunities. If venture capital funding is any indication, the explosion of telehealth platforms like those referenced above that shift the face-to-face encounter to a digital format will soon be rendered old-fashioned. In coming years, synchronous and asynchronous video telehealth encounters will be supplanted by super-streamlined, data-driven electronic services. A new generation of patients will expect specialized health services to be entirely digital transactions.

- Alternative Care Settings: As needs for higher acuity care have increased at the same time as the needs to minimize inpatient hospital and post-acute stays, we are seeing and expect to continue to see growing use of “extensivists,” who are focused on keeping people out of hospitals and in assisted living or outpatient care settings. Residential care settings, such as assisted living facilities, have seen an increasing level of acuity in the conditions they are expected to manage. In the social services arena, “SWAT” teams of case managers and mental health professionals, in partnership with physicians, are keeping more people out of psychiatric hospitalizations. In response to drug overdoses, non-medical detox options are growing in popularity, in lieu of hospitalizations.

The alternative care setting that merits singling out is the “hospital-at-home” trend, made possible by telemonitoring and home support services. Patients and families prefer to return home over impersonal, institutional settings, aligning with government and payor interest in reduced cost. This convergence of interest, coupled with growing technological support, is expected to fuel a driving interest in convalescing at home, with shorter hospital stays and at a lower cost.

- Physician Extenders: Physician shortages and cost factors have driven greater dependence on non-physician professionals: physician assistants (PAs), nurse practitioners (NPs) and other advance practice nurses (APRNs) to provide primary care services. In many states, nurse practitioners have full practice authority to operate independently of physicians. This model is breaking into new frontiers where physicians now predominate, such as long-term care. The future health professional workforce will look very different.

-

New Financial Models: Bundled Payment and Alternative Payment Models/Shared Risk | Pay for Performance | From Pay-and-Chase to Preauthorization

Since the enactment of the Affordable Care Act, the traditional financial models under which healthcare providers have operated have been in transition. As the ACA and other government changes have sought to control cost and reign in providers, fee-for-service, volume-based payment is being replaced with a number of different, experimental models of payment that provide incentives to focus on prevention, improve patient outcomes, boost patient safety and satisfaction, and reduce hospital readmissions.

- Bundled Payment/Shared Risk: The lines between providers and payors keep getting blurrier as a growing number of healthcare providers find their profits in sharing and managing risk, and plans experiment with direct provision of care. In an effort to reduce costs, payors increasingly are shifting risk to providers through bundled payments, in which hospitals or other coordinated systems receive a single, bundled payment that covers services delivered by multiple providers during a single episode of care or over period of time. This method of payment will predominate in several years, shifting the cost risk downstream by requiring coordination and negotiation over pricing by providers for a fixed sum paid by government health programs and private payors.

While bundled payments exemplify the growing focus on shared risk, they are the tip of the iceberg. The broader trend will be active patient management practices to ensure proactive stepping down to the lowest cost setting of care, including an expectation of higher acuity conditions being treated in lower level of care settings, the ultimate example being hospital-at-home treatment (see above) for conditions that previously would have warranted continued hospitalization or discharge to a skilled nursing facility.

- Pay for Performance: Traditionally, physicians have been paid for every service they provide, but this is falling from favor, as many payors begin to move to a pay-for-performance system, in which health professionals are paid for how well they are performing their jobs, with indicators such health care outcomes, hospital readmissions and patient satisfaction determining performance. Performance data will also drive health professional eligibility to participate in particular narrow networks.

- From Pay-and-Chase to Preauthorization: The predominant model of healthcare payment has been “pay and chase” where providers submit billing claims, payors pay those claims, and only later audit and seek repayment or recoupment of overpaid amounts. Increasingly, payors will shift to a model of seeking preauthorization and demonstration of medical necessity and documentation in advance to authorize payment of claims. This will be accompanied by growing reliance on the predictive analytics and data-mining tools utilized by the credit card industry to identify aberrational data through algorithms quickly, avoiding fraud, waste, and abuse.

-

Realignment: Consolidation | Coordinated Care | Evolving Competitive Landscape | Precision Health

The changing financial models are putting increased pressure on the business models of many healthcare providers, driving consolidation, as a new landscape demands greater scale for financial sustainability, and a new competitive landscape as old players realign and new entrants disrupt the existing healthcare marketplace.

- Consolidation: The pace of healthcare mergers in the past year has been fast and furious, as the economics of hospital business operations have been upended by the suppression of hospital admissions and changing reimbursement rules. This M&A activity is unlikely to slow down anytime soon. Providers who were profitable five years ago find themselves barely at break-even. Providers who were at break-even find themselves losing money. The changing reimbursement landscape has made size, scale, and leverage necessities for profitability. Significant consolidation is expected to broaden across additional healthcare sectors, including post-acute and home health agencies.

- Coordinated Care: While our current system is predominantly fragmented care, the trend towards coordinated care will accelerate, with a greater role for care coordination of patient needs comprehensively across settings, making sure that patients are treated efficiently and seamlessly. The goal is to track quality, reduce duplicative diagnostics, ensure access to what other providers are doing, and simultaneously manage and reduce risk, improve the quality of care and reduce fraud, waste, and abuse. In the process, population health can be managed much more effectively through the use of data analytics and predictive tools to flag warning signs and high-risk events and identify gaps in care.

- Evolving Competitive Landscape: The competitive landscape in healthcare is undergoing rapid transformation. Part of this reshaping is attributable to consolidation: hospitals, post-acute providers, physician groups, even health plans are growing into larger organizations. Another part of the changes are the emerging collaborations between existing providers to share risk and coordinate care. But there is another factor at work too—the disruptive force of the non-healthcare business eyeing opportunities in the healthcare marketplace, either as new entrants or in partnership with existing healthcare companies. Larger retailers, like Walmart, are investing in growing their presence and leveraging their experience in meeting consumer needs in healthcare. Technology companies and investors are looking for opportunities to innovate and use connectivity to disrupt healthcare sectors. Spas, food companies, apparel makers, gyms, and wellness companies are exploring opportunities. The results respond to consumer-driven demand, but present challenges for the existing market players.

- Precision Health: The combination of health informatics, collaboration, and the ongoing advances in biomedical research are driving towards unprecedented level of precision in medical care and generally greater return on investment (ROI) in healthcare treatment. The revolution is apparent in research and treatment of cancer, neurologic and cardiac disease, and study of the human genome. The next several years will be a time of new diagnostic tests, new therapies, and the ability to personalize care and develop precision medications. For example, by understanding a patient’s DNA (or RNA) sequence, providers can assess the existing genetic variations that can account for possible diseases, and assess how that patient will likely respond to a certain treatment. With this level of personalized information, diagnostics and therapeutics, there will be less investment in costly treatments that ultimately fail.

Where do we go from here? With so much change afoot, surviving and thriving through all of the transformation underway is not about any one solution, but about finding an overarching strategy and planning for a changed healthcare universe. There are no “magic bullets” or one-size-fits all solutions, but rather real work ahead. Understanding the change underway is a first step on the journey.

For more information/questions regarding any legal matters, please email [email protected] or call 310.203.2800.